salt tax cap married filing jointly

If you paid 5000. For married taxpayers filing separately the cap is 5000.

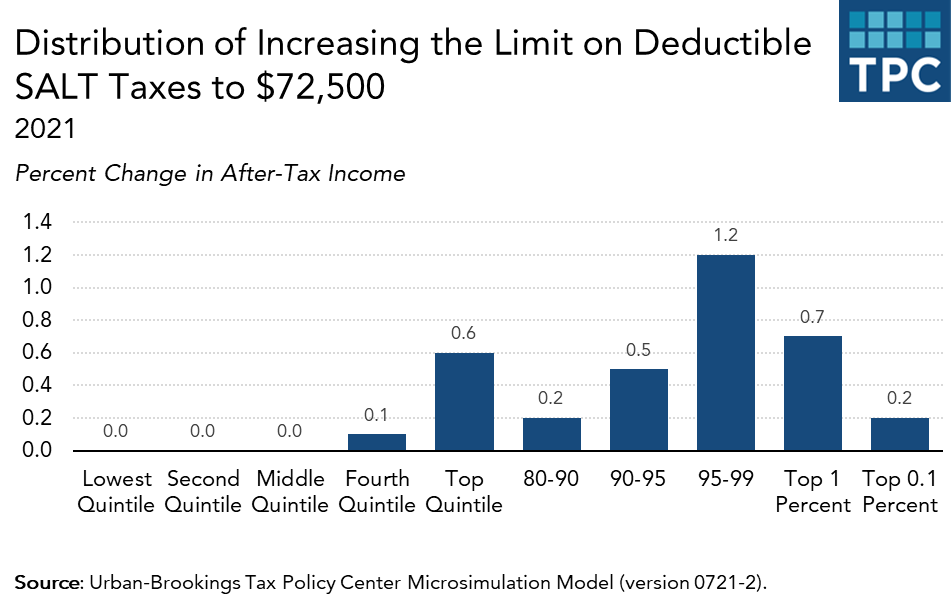

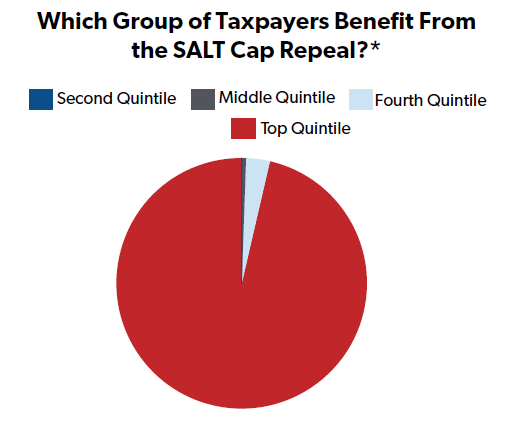

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People Tax Policy Center

My partner and I each received 1099gs in a high tax state.

. While the TCJA included some tax provisions. 52 rows The deduction has a cap of 5000 if your filing status is married filing. The limit is 5000 if married filing.

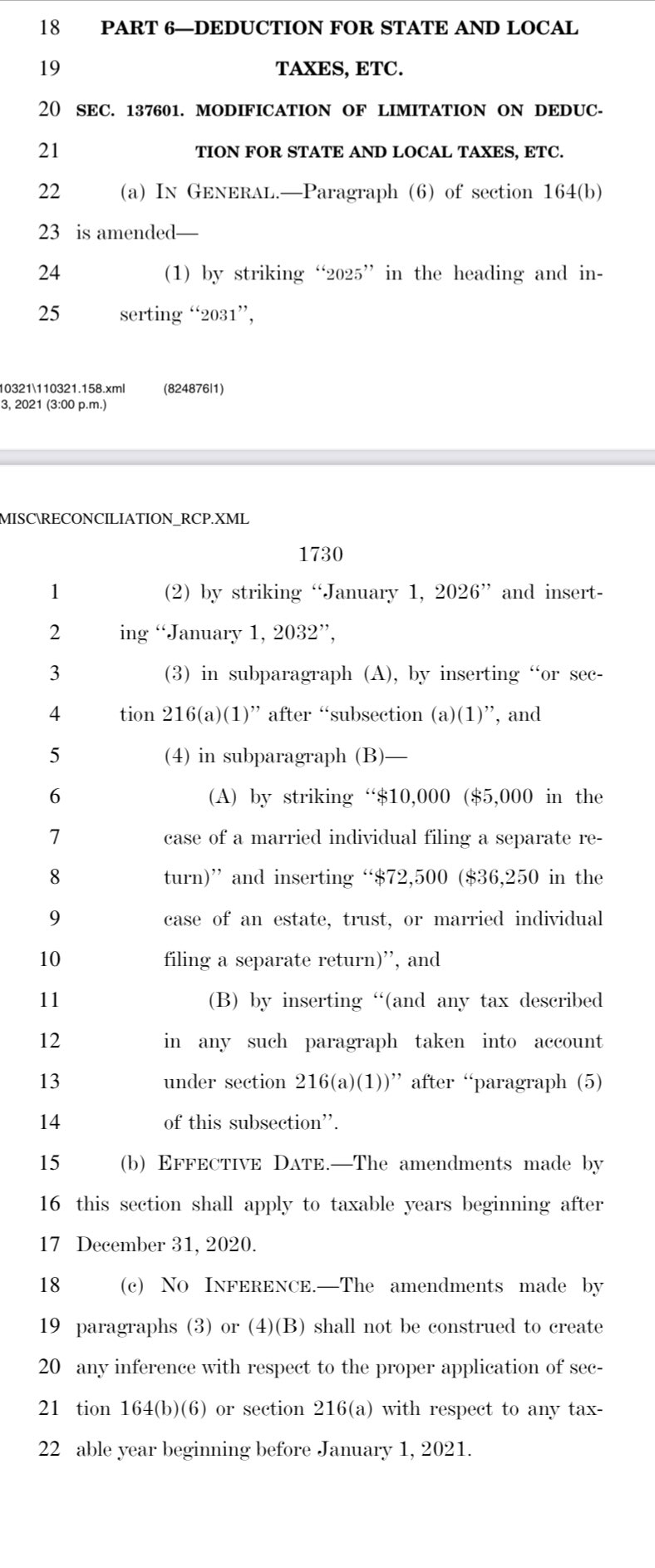

As alternatives to a full repeal of the cap lawmakers and. The proposal also addresses an unfair. This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples.

Salt cap of 10000. Head of household filers and married taxpayers filing jointly. Trying to figure out how much of our 2018 state refund.

The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. New tax law for 2018.

Is this the same number for single married filing jointly and married filing singly. Do we combine our state and local income. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

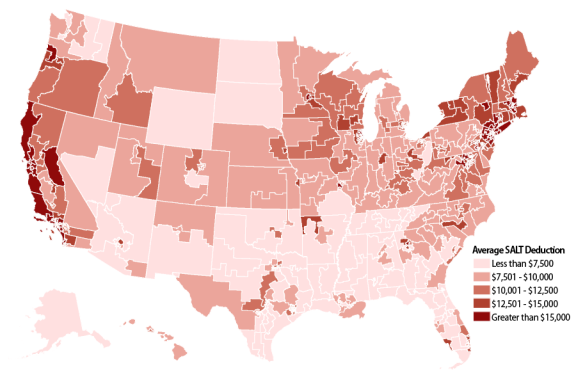

Pdf Introduction Some lawmakers are seeking to repeal the 10000 cap for single and married couples jointly filing on state and local. T he state and local tax SALT. Under TCJA the SALT.

Pdf Introduction Some lawmakers are seeking to repeal the 10000 cap for single and married couples jointly filing on state and local tax SALT deductions put in place. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize. The measure dubbed the Restoring Tax Fairness for States and Localities Act or HR 5377 proposes increasing the so-called SALT cap to 20000 for married taxpayers who.

The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. New tax law for 2018. Under tcja the salt deduction was.

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

The federal tax reform law passed on Dec. By limiting the SALT deduction. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

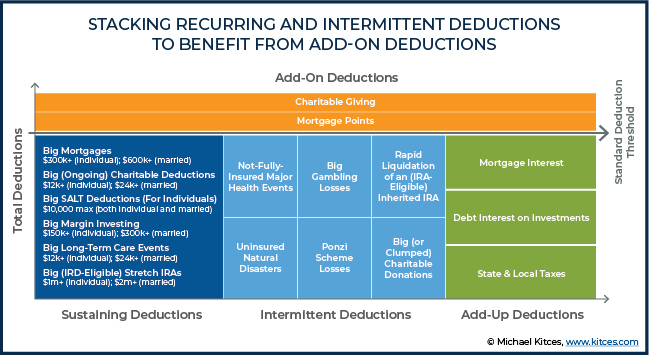

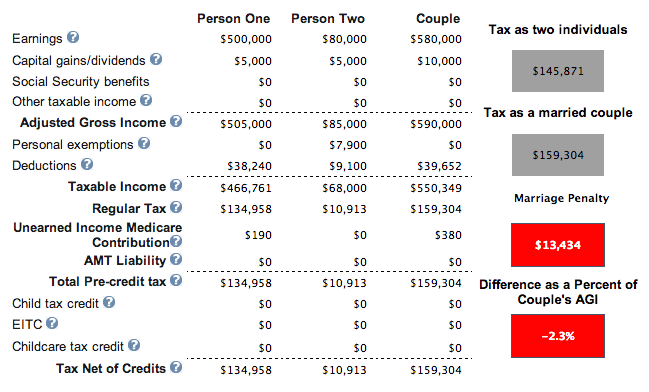

It is 5000 for married taxpayers filing. The SALT workaround is an option for the. The marriage penalty has long been considered an unfair tax that results in a higher tax burden solely based on marital status.

Hello Its my first time filing a joint return for 2019 year.

Salt Deductions Property And Income And Sales Tax Oh My

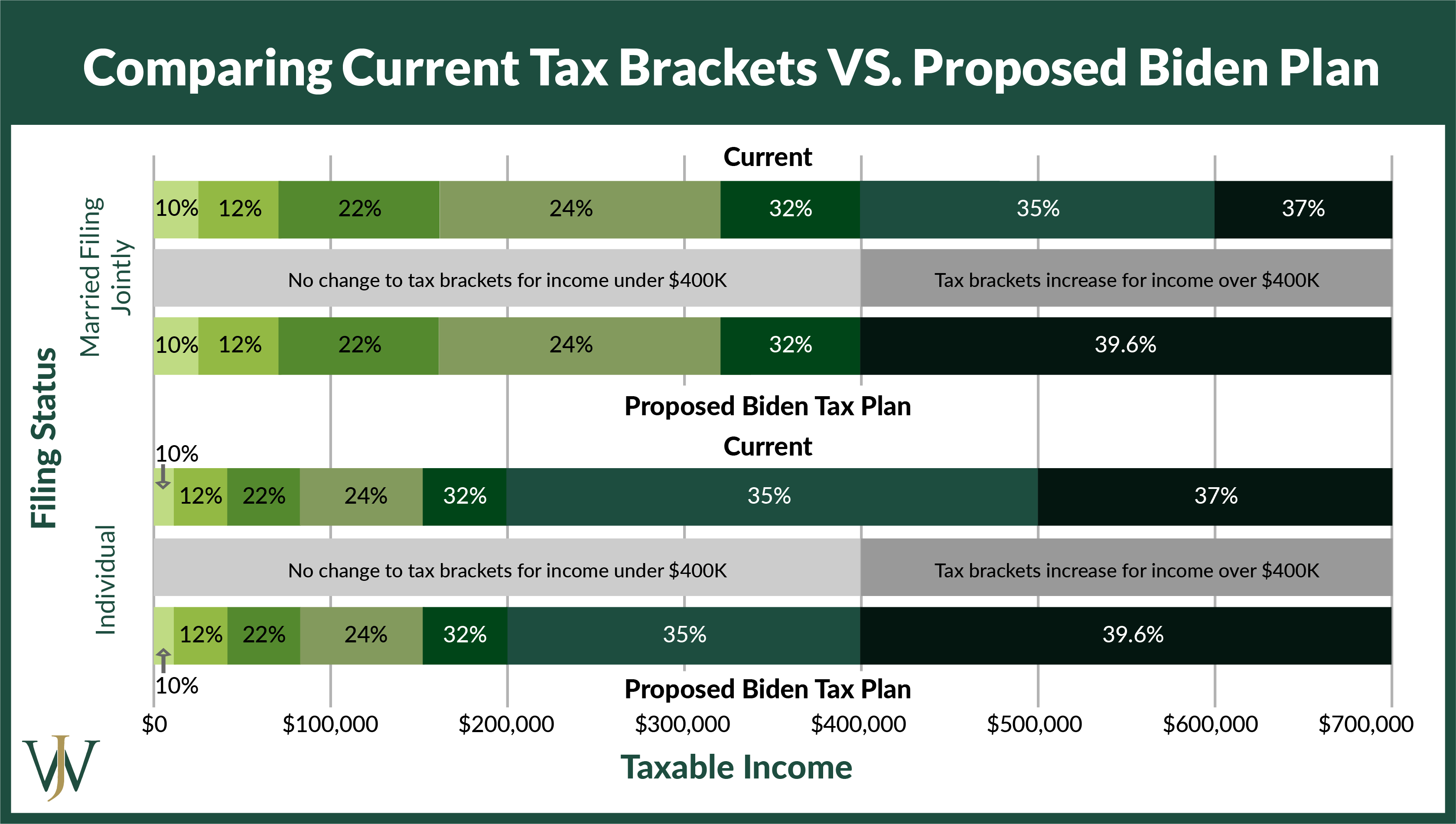

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

Tax Foundation On Twitter Nkaeding Waysmeanscmte Prior To The Tcja The Amt Hit Taxpayers Making Between 200 000 And 500 000 Hardest In 2015 Almost 60 Of Taxpayers In That Income Range Were Subject

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

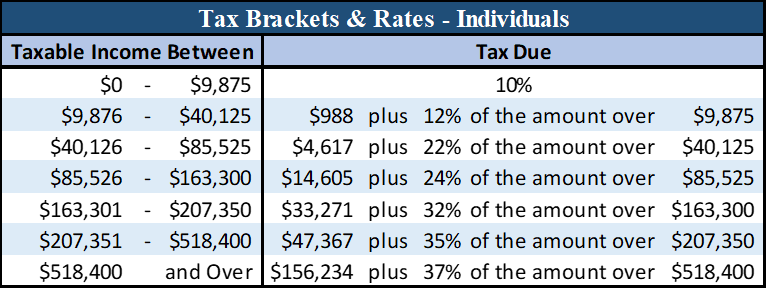

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More Blackman Sloop

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

What Are The Tax Benefits Of Marriage Personal Capital

The Salt Cap Overview And Analysis Everycrsreport Com

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Blue States File Appeal In Legal Battle Over Salt Tax Deductions

What Is The Salt Tax Deduction Forbes Advisor

Wedding Season 4 Tax Reasons To Reconsider I Do Thestreet

State And Local Taxes What Is The Salt Deduction

The Marriage Penalty Tax Has Been Abolished Hooray

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

:max_bytes(150000):strip_icc()/GettyImages-56970357-5867cc515f9b586e02191b68.jpg)